The High LTV Refinance Option program (HIRO) was designed to benefit many Americans by offering new refinance options. Borrowers who have purchased homes since late-2017 and made a small down payment could especially benefit from this program.

Basics of the HIRO Program

The HIRO program, administered by Fannie Mae, is a loan program designed to help get homeowners a lower rate and payment options even in circumstances where they may have little or no equity in their home yet. The HIRO program is very different from most other refinancing programs, as they usually require equity in order to refinance no matter how good your income or credit rating may be.

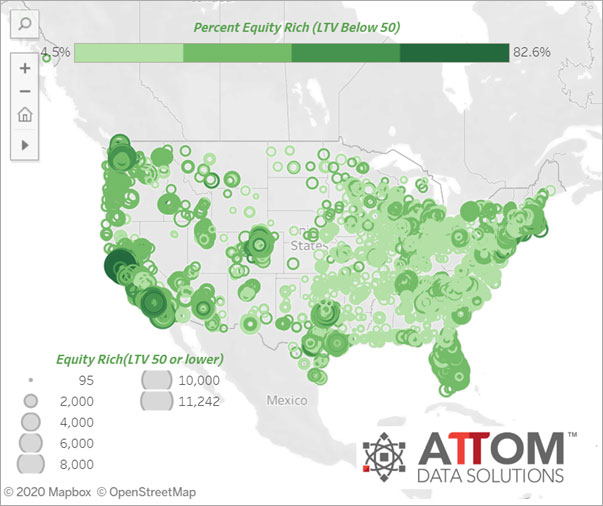

And while the appreciation of homes has generally occurred for most areas in the nation, this appreciation isn’t uniform, and other regions are experiencing stagnant home prices or even depreciation. The rise in equity potential is very uneven, and the latest data shows that in the fourth quarter of 2019, 3.5 million US homes – one in 16 - were seriously underwater with a mortgage loan balance that is at least 25% higher than their home’s value. These borrowers are the ones that the HIRO program could advantage the most.

Criteria for the HIRO Program

While many mortgages will qualify for the Fannie Mage High LTV Refinance option, not all mortgages or property owners will be eligible. Initial qualifying criteria include:

- Holding a mortgage that is currently owned by Fannie Mae.

- The mortgage must have originated on or after October 1, 2017.

- There must be a 15-month interim between when your initial loan originated and when the refinanced loan is opened.

- The mortgage can have no 30-day late payments within the last six months, not more than one 30-day late payment in the previous 12 months, and no delinquency greater than 30 days.

- Reverification of income by one of the following methods:

- Verbal verification of current employment or self-employment by at least one of the listed borrowers.

- Documentation of non-employment income, such as pension or Social Security.

- Documentation of liquid financial reserves equaling at least 12 months of the new full housing payment, including insurance, taxes, and any other associated expenses.

Aside from there criteria, there are few other requirements for qualification. Lenders generally aren’t required to consider credit scores, since the borrow has an excellent financial history in relation to the property that is being refinanced. This requirement may vary from lender to lender, though, as some may add additional requirements on top of what is required by Fannie Mae.

Additionally, there is no debt-to-income ratio ceiling. The rationale behind this is that the refinance will likely lower monthly costs for the borrower, meaning they will be in a better financial position no matter what their debt-to-income ratio currently is. However, if for some reason, the refinance were to increase your payment by more than 20% or you were removing a borrower from the loan, a new debt-to-income ratio would be necessary. The Alternative Qualification Path may be applicable in this instance, too, as it is generally necessary for situations where the lender has to requalify the loan because it is changing the loan significantly.

Bank statements are generally also not necessary unless your payment is increasing by more than 20%, or you are removing a borrower for the loan.

HIRO and Home Appraisals

The requirement for a home appraisal is a little bit more complicated. Some loans will need new ones; others will not. The determination on whether a home appraisal is necessary is made when the borrower completes and submits a full application with the lender. Those loans that do not need a new appraisal will receive an appraisal waiver, which is ideal since it saves the borrower time and money.

However, if you do need a new appraisal, this is often not a barrier to securing a HIRO refinance since the program sets no maximum LTV, meaning that the appraised value can’t come in too low.

HIRO and LTV Ratios

The biggest advantage of the Fannie Mae High LTV Refinance option is that there is no maximum loan-to-value (LTV) for 30- and 15-year fixed-rate mortgages. This allowance ensures that even loans with high LTVs (in excess of 125% of the home’s current value) can qualify and enjoy the benefits of the program. Adjustable-rate mortgages are still eligible for HIRO refinancing, but they do have a maximum LTV value of 105% of the property’s value. ARM loans with higher LTVs would be ineligible.

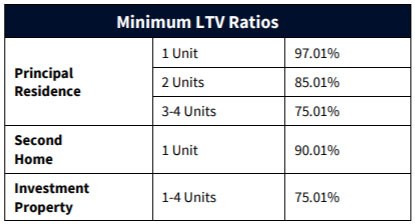

Despite having no maximum LTV, there are minimum LTVs. That means many borrowers may have too much equity to qualify for the HIRO program if they are in an area that has had rapid appreciation. For single-family homes that are primary residences, this figure is 97.01%, although Fannie Mae has published the maximum LTV values for other types of properties as well.

Provided the property being refinanced meets these minimum LTV thresholds, as well as other conditions, then the mortgage may be eligible for the program.

Benefits of the HIRO Program

The HIRO program can offer multiple benefits for potential borrowers depending upon their unique circumstances, including but not limited to:

- A reduced monthly principal and interest payment, meaning the borrower will likely pay less each month and over the life of the loan.

- A lower interest rate for the life of the loan. Today’s rates are at historic lows, making it an ideal time to refinance using HIRO.

- A shorter amortization term if you switch from a 30-year to a 15-year term allowing you to build equity faster.

- A more stable mortgage solution – such as may be experienced when an adjustable-rate mortgage is refinanced to a HIRO fixed-rate mortgage.

- Simplified financial documentation requirements.

- Transferrable mortgage insurance.

The HIRO program, as a replacement to the HARP loan program, is an excellent option for borrowers who haven’t experience home appreciation as they may have expected. Given the current, historically low-interest rates, it may be an excellent time to explore whether HIRO refinancing is an option for you.