Whether you are a small or large enterprise business owner from New Jersey, there may come a time when you need to acquire a loan. The main reasons for doing so are expansion, building upgrade, facilities and so on.

But before you head on to the nearest New Jersey Commercial Mortgage Company, it is essential to know the four major types of mortgages available to business owners like you.

There are four general types of mortgages: fixed-rate, variable-rate or adjustable rate, interest only and balloon payment.

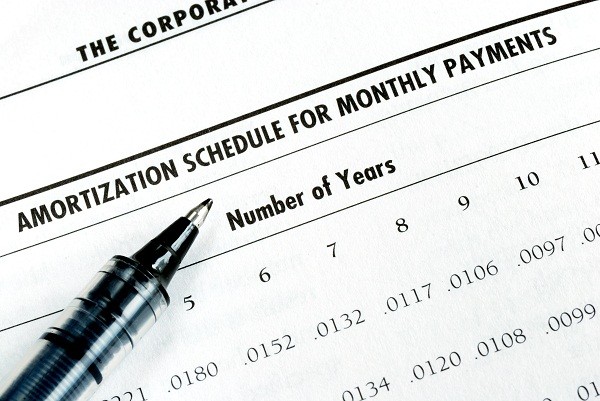

Among the four, the fixed rate mortgage is the most popular, probably due to its straight forward setup; plain and simple, with no surprises in store. Once you acquire the loan, your lender will add the interest then divide it into monthly amortized payments. The price of your amortization will depend on the number of months you agree to pay your mortgage in.

The adjustable mortgage rate on the other hand, is the opposite of the fixed rate type. Rates vary according to market changes, thus enabling you to enjoy low interest rates. Of course, you’ll have to adjust your payments when the market dictates it.

However, some business owners would rather pay lower rates so they can use their money for other things besides paying fixed or variable rates. If you fit this bill, then you might want to consider the interest-only or balloon payment mortgage. The first will require you to pay your loan’s interest alone before it reaches maturity, after which you need to pay the entire mortgage.

The balloon payment is slightly similar to interest-only mortgages. The difference is, you will not be paying for interest alone – a specified portion of your loan will be calculated with your interest, then divided into the number of months you wish to pay. Be warned, however, that your remaining balance must be paid before the maturity date. Otherwise, you’ll have to make a secondary mortgage in order to pay.

Being aware of the commercial mortgages that are available to you may bring you a step closer to your meeting your needs. Just remember to be a responsible borrower at all times.